Stock and bond exchanges thrive on being global, but their fortunes have also long been tied to the politics of the nation state.

This is why the industry’s top executives and dealmakers will be watching Italy, where MTS, a Milan-based platform that executes about €13.5bn of sovereign bond trades a day, and Borsa Italiana, the country’s stock exchange and home to many high-profile companies, may change hands for the first time in more than a decade.

The London Stock Exchange has earmarked the Italian businesses, prized since the UK group acquired them for €1.6bn in 2007, for potential sale as part of an effort to persuade EU regulators to approve its $27bn purchase of financial data and trading group Refinitiv — a deal the LSE has said will transform its prospects.

But a possible auction of the two linchpins of Italy’s financial markets comes just as the pandemic has sharpened the interventionist instincts of the country’s government. Earlier this year Prime Minister Giuseppe Conte strengthened Italy’s “golden share” powers, which limit foreign investment in sectors regarded as key national infrastructure. The wide-ranging definition includes everything from defence to communications.

“For Italy, for the state and central bank, the bond trading aspects are so fundamental, they may say the only way it can work is for Italy to have control,” said Patrick Sarch, an M&A lawyer in London at White & Case.

The UK exchange has outright ownership of Borsa Italiana, which has a 62 per cent stake in MTS. The rest of the bond platform is owned by a group of banks including JPMorgan Chase, Citigroup and Intesa Sanpaolo. The LSE has said there could be “potential benefits” of selling the businesses together.

Although the Italian government has yet to declare its position on the future of Borsa Italiana and MTS, it has quickly moved to pull together a potential bid, according to several people familiar with the matter.

Rome has instructed state-owned lender Cassa Depositi e Presiti to work on a joint bid for Borsa Italiana with Euronext, the owner of multiple European stock exchanges, including the Parisian bourse, the people said.

Last week CDP and Euronext sent the LSE an expression of interest in MTS and will do the same for Borsa Italiana later this month, the people added.

“[Borsa Italiana] is highly strategic for the country,” said Davide Zanichelli, a member of parliament for Five Star, the senior partner in Italy’s ruling coalition. “The government must work with all interested parties, not just the French, in order to join the bid that addresses Italian companies’ needs best.”

The politics threaten to complicate a process that could prove key to unlocking support in Brussels for the Refinitiv deal, the most ambitious in the LSE’s history and one welcomed by shareholders when it was announced just over a year ago. In late July, the LSE said it had begun exploratory discussions over the sale of MTS and the Italian stock exchange, but declined to give further details.

If MTS and Borsa Italiana hold political value for the government, they have commercial appeal for rival exchange groups. Indeed, the LSE resisted selling its Italian operations in 2017 as it and Deutsche Börse, owner of Germany’s stock exchange, faced pressure from Brussels to make concessions to win support for their ultimately abortive €29bn tie-up.

Euronext’s chief executive Stéphane Boujnah told the Financial Times in July that “we can monitor all other situations” because the group’s shares are trading at a record high.

Deutsche Börse is also interested in Borsa Italiana, according to Italian officials, but the government sees Euronext as a more suitable partner.

They said that the Milanese exchange may also draw interest from SIX, the Swiss stock exchange operator that recently acquired Spain’s main bourse.

“The aim is to bring Borsa Italia back to Europe with a strong presence of the CDP to safeguard the national interest,” one of the officials said.

Italy’s finance ministry is “closely monitoring” the situation, a spokesperson said. The LSE, Euronext, CDP, Deutsche Börse and SIX declined to comment.

It is not hard to see why Rome wants to make its voice heard over the future of the country’s bond and stock exchanges.

MTS is home to the bulk of trading in Italian government bonds. The pandemic is expected to propel the country’s borrowing as a share of gross domestic product to 155 per cent, according to the Bank of Italy, cementing its position as the eurozone’s largest sovereign debt market.

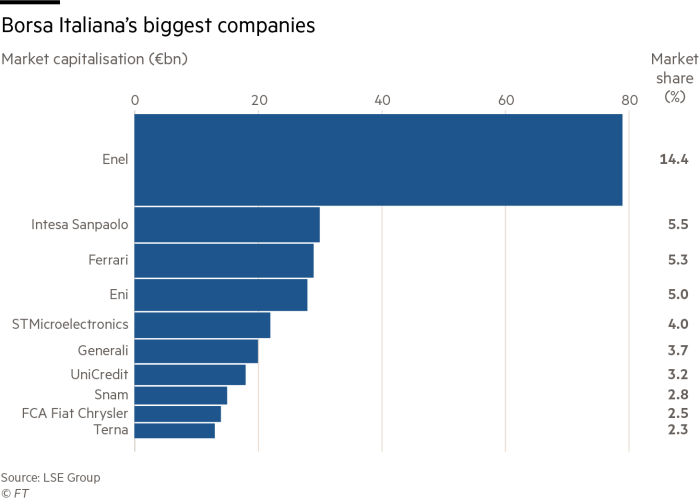

Borsa Italiana, meanwhile, operates the main stock exchange in Milan, the clearing house CC&G and Monte Titoli, a settlement unit. Intesa Sanpaolo, Telecom Italia, Mediaset and Enel are among the companies with shares trading on the Milanese bourse.

Mr Sarch of White & Case says that should the LSE ultimately decide to sell the exchanges, the London-headquartered group will have to balance the political pressure to accept a bid involving the Italian government against achieving the best price for its own shareholders.

LSE chief executive David Schwimmer could use interest from rival exchange groups to help lift the sale price for Borsa Italiana, said Mr Sarch, adding that “an offer from a non-Italian acquirer would set a floor valuation”.

Although the LSE has insisted that no sale is certain, Chris Turner, an analyst who follows the industry at Berenberg, reckons that the lofty valuations stock exchanges are currently trading at favours a disposal — assuming it proves enough for EU regulators to give the green light to the Refinitiv deal.

“Cash equity exchanges like Borsa Italiana currently trade at only a circa 5 per cent discount to derivative exchanges, down from a 20 per cent discount five years ago,” said Mr Turner.

Using the 21 times full-year earnings that Euronext and Spanish exchange operator BME are valued at, analysts have put a price tag of between €2.5bn and €3.2bn on Borsa Italiana. Analysts at Redburn value MTS at between €480m and €580m.

The Italian government is also aware that partnering with Euronext, which raised €500m through a bond sale earlier this year, would offer the necessary expertise in running the exchanges. Analysts say that both Euronext and Deutsche Börse could run MTS and Borsa Italiana on their existing technology platforms, cutting costs.

While the future ownership of MTS and Borsa Italiana is yet to be decided, there is no doubt that the economic crisis unleashed by the pandemic has emboldened the government to intervene in corporate Italy on a bigger scale.

In July, Rome sought to secure a majority stake in Autostrade per l’Italia, the toll road business at the centre of the fatal collapse of a Genoa bridge in 2018. It is also pushing for the creation of a single national fibre network co-owned by Telecom Italia, other network operators and the CDP.

The LSE’s need to win over Brussels regulators could provide the government with its biggest chance yet to use its newly established powers.

"exchange" - Google News

September 07, 2020 at 10:01AM

https://ift.tt/331k77G

Italian stock exchange tests Rome’s appetite for intervention - Financial Times

"exchange" - Google News

https://ift.tt/3c55nbe

https://ift.tt/3b2gZKy

Exchange

Bagikan Berita Ini

0 Response to "Italian stock exchange tests Rome’s appetite for intervention - Financial Times"

Post a Comment